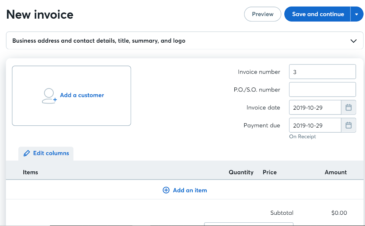

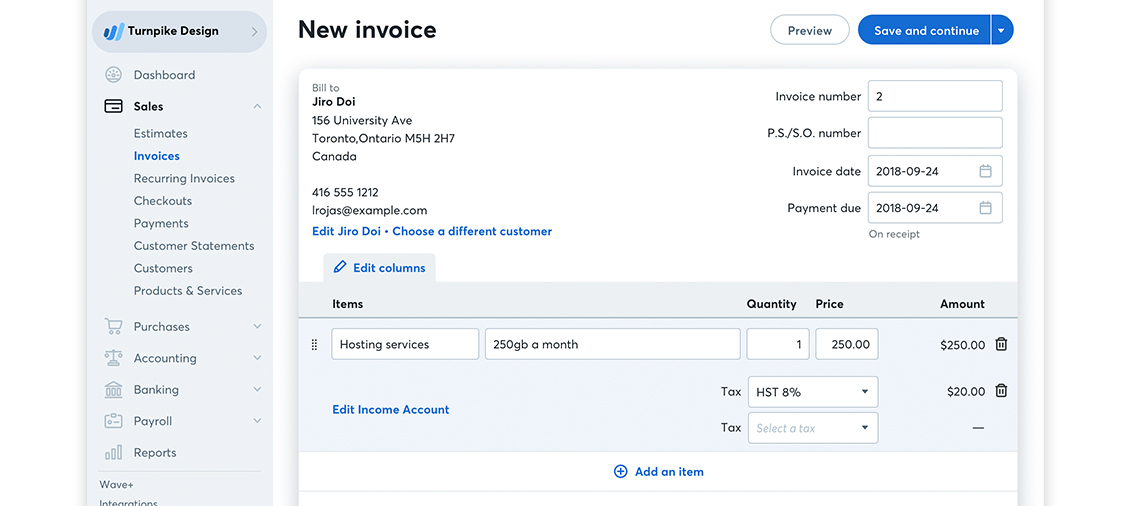

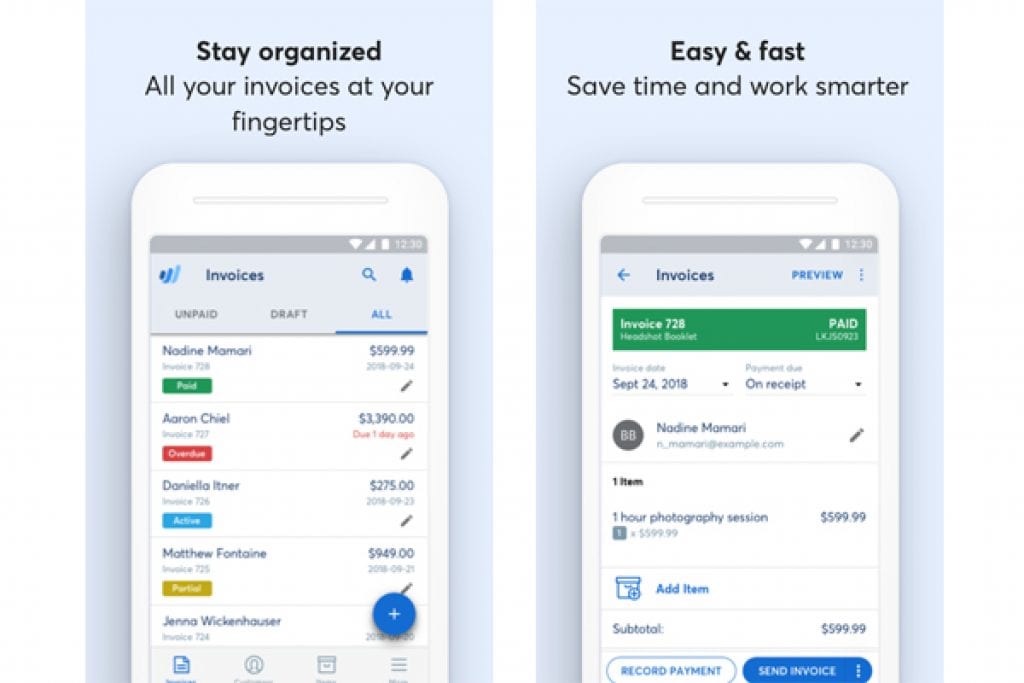

This makes sense – after all, Wave wants to guide all its free users towards its own payment processing fees – but it's a restriction that will annoy any small business that's already happy with another payment service. Wave supports its own first-party payment processing, but won't allow any third-party integrations to process payments through the Wave platform. It also allows users to send and receive invoices through the Wave mobile app, so it's easy to use while on the go. Wave fully delivers on its invoicing delivery tools: The service lets users easily set up recurring invoices (a key time-saving feature), supports payment reminders, and tracks invoices so users will know when they've been opened. It's not bad at all, but several services are better, with Zoho Invoice in particular coming out ahead – in fact, it supports every feature mentioned here. This makes Wave ultimately a middle-of-the-road service for invoice creation specifically. Missing features? An invoice by Wave won't add tracked hours, won't display discounts, and doesn't allow file attachments. The invoices can calculate taxes and create estimates, while offering multi-currency support – all useful features for a versatile invoicing service. While the number of core templates is a little low at just three, you'll be able to add a company logo, customize colors, and include customer notes. Wave offers a decent range of invoice creation tools and abilities. Here's a table with some real-life examples of the three different types of payment processing fees you'll see while using Wave Invoicing:

Regardless of which options you're using, the core invoicing ability that Wave offers remains free.

#Invoicing wave plus

#Invoicing wave full

The break down of the transaction costs and what features you'll get can be a bit complicated, so read on for a full summary, as well as the pricing behind Wave's Payroll add-on. It's not just for invoices, either, offering general finance management tools as well. The Wave platform has high invoicing functionality and great customer service options, even if a few features are limited.

This means that if you make no sales (knock on wood), you won't pay a penny. However, you will pay a processing fee for any money collected through the service: This fee is 1% for bank payments, and around 3% to 3.5% for credit payments. However, this may change in the future, and we want you to have all the information you need to make the right decisions for your business.Wave Invoicing is free, in the sense that it comes with no monthly charge. Wave has no current plans to close or restrict access to existing accounts for customers outside the US and Canada. You can accept Stripe payments for invoices created before March 31 until the Stripe connection closes on June 30. March 31, 2021, is the last day you will be able to send Stripe payment-enabled invoices, including auto-payment enabled recurring invoices. Additionally, Wave’s Stripe connection will end on June 30, 2021, for businesses outside the US and Canada. Businesses located in other countries will not be able to sign up for a Wave account after November 30.Ĭurrent wave customers will still have their accounts active but will no longer be able to send Stripe payment enabled invoices. As of November 30, 2020, new Wave account sign-ups are limited to US and Canadian business owners only. Beginning December 2020, Wave will devote our product development resources solely to the United States and Canada.

To support this evolution, Wave is recentering focus on our local market. In simple terms, we’ve realized we need to change the way Wave allocates our resources and focus. Here is an excerpt from the email To continue delivering a product that meets our standards, it’s become clear that we need to adapt our approach. The announcement was made via email to its millions of small businesses who use wave as their preferred accounting software. In a stunning email to it's customers outside of the US and Canada, wave CEO Kirk Simpson, has stated that Wave will no longer be able to support businesses outside of the US and Canada.

0 kommentar(er)

0 kommentar(er)